Grasping Medicare Advantage Plans

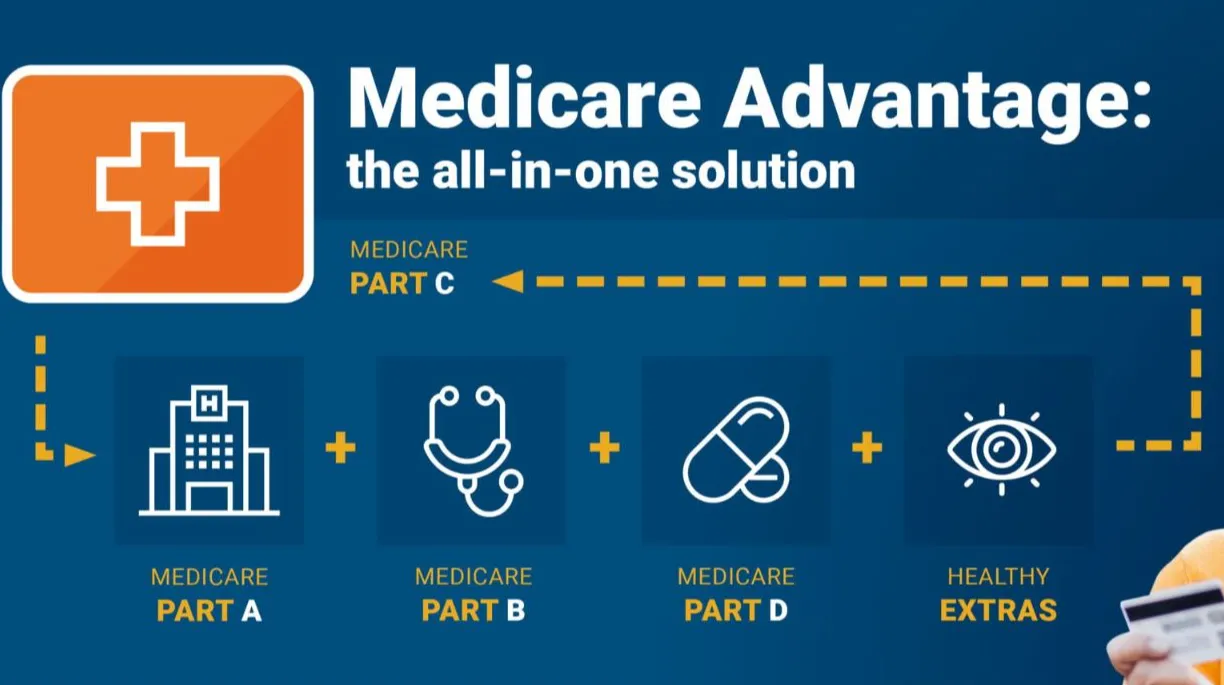

Medicare Advantage Plans are provided by independent Insurance providers that contract with Medicare to offer Part A not to mention Part B protection in one combined structure. Different from Original Medicare, Medicare Advantage Plans frequently feature supplemental services such as prescription coverage, oral health care, vision services, also wellness programs. Such Medicare Advantage Plans function within specific service areas, which makes geography a important element during comparison.

Ways Medicare Advantage Plans Differ From Traditional Medicare

Original Medicare provides broad medical professional availability, while Medicare Advantage Plans often use structured networks like HMOs as well as PPOs. Medicare Advantage Plans may require provider referrals and/or network-based providers, but they frequently balance those restrictions with predictable costs. For numerous beneficiaries, Medicare Advantage Plans deliver a blend between affordability as well as added benefits that Traditional Medicare independently does not include.

Which individuals May want to Consider Medicare Advantage Plans

Medicare Advantage Plans are well suited for beneficiaries interested in managed care and possible cost savings under one plan structure. Seniors managing chronic medical issues often select Medicare Advantage Plans because connected treatment structures reduce complexity in ongoing care. Medicare Advantage Plans can additionally interest individuals who desire bundled coverage options without handling separate secondary policies.

Qualification Guidelines for Medicare Advantage Plans

To enroll in Policy National Medicare Advantage Plans Medicare Advantage Plans, participation in Medicare Part A and Part B must be completed. Medicare Advantage Plans are available to most individuals aged sixty-five plus older, as well as younger people with eligible disabilities. Participation in Medicare Advantage Plans relies on residence within a plan’s coverage region plus timing that matches approved sign-up windows.

Best times to Choose Medicare Advantage Plans

Scheduling holds a vital part when selecting Medicare Advantage Plans. The Initial sign-up window surrounds your Medicare eligibility date and also enables initial selection of Medicare Advantage Plans. Overlooking this period does not necessarily remove access, but it does alter available opportunities for Medicare Advantage Plans later in the calendar cycle.

Yearly together with Qualifying Enrollment Periods

Each fall, the Annual enrollment window allows beneficiaries to change, remove, and/or add Medicare Advantage Plans. Qualifying enrollment windows are triggered when qualifying events occur, such as moving alternatively loss of coverage, enabling adjustments to Medicare Advantage Plans beyond the standard schedule. Knowing these periods helps ensure Medicare Advantage Plans remain within reach when situations change.

Ways to Evaluate Medicare Advantage Plans Properly

Comparing Medicare Advantage Plans demands attention to factors beyond recurring payments alone. Medicare Advantage Plans differ by provider networks, out-of-pocket maximums, prescription formularies, together with coverage rules. A detailed assessment of Medicare Advantage Plans helps matching medical needs with plan designs.

Expenses, Benefits, plus Provider Networks

Recurring costs, copays, plus annual maximums all shape the value of Medicare Advantage Plans. Certain Medicare Advantage Plans offer reduced monthly costs but higher out-of-pocket expenses, while others prioritize predictable expenses. Doctor access also varies, which makes it important to verify that chosen doctors work with the Medicare Advantage Plans under review.

Drug Coverage plus Additional Benefits

A large number of Medicare Advantage Plans include Part D prescription benefits, easing medication management. In addition to medications, Medicare Advantage Plans may offer fitness programs, ride services, even over-the-counter allowances. Reviewing these extras helps ensure Medicare Advantage Plans match with daily medical priorities.

Enrolling in Medicare Advantage Plans

Sign-up in Medicare Advantage Plans can occur online, by phone, and through licensed Insurance professionals. Medicare Advantage Plans call for correct individual details with verification of qualification before activation. Submitting enrollment properly helps avoid delays plus unplanned benefit gaps within Medicare Advantage Plans.

Understanding the Importance of Licensed Insurance Agents

Authorized Insurance professionals assist interpret plan specifics also outline distinctions among Medicare Advantage Plans. Connecting with an experienced professional can address network restrictions, benefit boundaries, in addition to costs associated with Medicare Advantage Plans. Expert guidance commonly streamlines the selection process during enrollment.

Common Errors to Prevent With Medicare Advantage Plans

Ignoring provider networks stands among the common errors when evaluating Medicare Advantage Plans. Another problem centers on concentrating only on premiums without reviewing overall expenses across Medicare Advantage Plans. Examining coverage documents thoroughly prevents misunderstandings after enrollment.

Reassessing Medicare Advantage Plans Each Year

Healthcare needs evolve, plus Medicare Advantage Plans change each year as well. Evaluating Medicare Advantage Plans during open enrollment permits updates when benefits, costs, and also providers shift. Consistent assessment helps keep Medicare Advantage Plans consistent with present medical needs.

Reasons Medicare Advantage Plans Keep to Expand

Enrollment patterns indicate rising engagement in Medicare Advantage Plans across the country. Broader benefits, defined out-of-pocket limits, not to mention managed care contribute to the appeal of Medicare Advantage Plans. As offerings multiply, well-researched comparison becomes increasingly valuable.

Long-Term Value of Medicare Advantage Plans

For numerous individuals, Medicare Advantage Plans provide stability through connected coverage in addition to structured care. Medicare Advantage Plans can lower administrative complexity while encouraging preventative services. Choosing suitable Medicare Advantage Plans creates peace of mind throughout retirement years.

Compare with Enroll in Medicare Advantage Plans Today

Making the right step with Medicare Advantage Plans starts by reviewing local choices and also confirming eligibility. If you are currently entering Medicare alternatively revisiting existing coverage, Medicare Advantage Plans present flexible coverage options designed for different medical priorities. Compare Medicare Advantage Plans today to find a plan that supports both your medical needs with your budget.